Lower interest rates. Now what?

The Federal Reserve recently voted to cut interest rates, shaving 0.5% off the benchmark.1

Markets rallied exuberantly at the news, reaching new highs.2

Why did the Federal Reserve cut rates?

With inflation on a strong downward trajectory and concerns about economic weakness rising, the Fed clearly decided now was the right time to cut.

The size of the cut was a surprise to many, who expected a quarter-point cut and could indicate that the Fed feels strong action is warranted.

Some analysts believe lowering interest rates will lower the risk of a recession and increase the odds of a “soft landing” for the economy.3

What do lower rates mean?

The Fed is responsible for setting the benchmark interest rate that all other borrowing rates follow.

A lower benchmark will reduce borrowing costs for businesses and consumers, helping economic growth accelerate in the months to come.

While, generally, commercial rates don’t change immediately after a rate cut, they tend to follow the same trend.

Going forward, mortgages will become cheaper, likely boosting the real estate market.

Business borrowing costs will drop, giving a bump to industries like technology, which rely on credit to fund R&D.

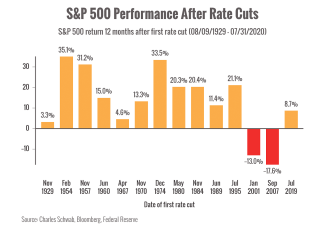

Historically, stocks have tended to do well when rates drop.4

However, past performance doesn't predict the future and there’s no guarantee that equities will follow any conventional path.

Today’s volatile markets are still grappling with post-pandemic distortions and are dominated by high-flying tech stocks.

What could happen next?

Markets have rallied strongly in 2024, largely on hopes of lower interest rates.

Now that the Fed has finally cut rates, it’s likely that traders will turn their attention to other factors.

We expect the presidential election to come into focus as we approach November.

Analysts will also be closely reading economic reports for hints about recession risks and economic growth in 2025.

All told, we’re expecting plenty of volatility ahead.

We’re watching closely and researching different market scenarios for Q4 and 2025.

If you have any questions or concerns, please don’t hesitate to reach out.

Sources:

1. https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html

2. https://www.usatoday.com/story/money/2024/09/19/dow-sp-500-record-fed-cut/75297962007/

4. https://www.schwab.com/learn/story/what-past-fed-rate-cycles-can-tell-us

Chart sources:

https://fred.stlouisfed.org/series/DFF

https://fred.stlouisfed.org/series/MORTGAGE30US

https://fred.stlouisfed.org/series/BAMLC0A1CAAAEY

https://fred.stlouisfed.org/series/TERMCBCCALLNS

https://www.schwab.com/learn/story/what-past-fed-rate-cycles-can-tell-us

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Content prepared by Snappy Kraken.

The S&P 500 is an unmanaged composite index considered to be representative of the U.S. stock market in general. Past performance is no guarantee of future results. Indices are unmanaged, do not incur fees, costs, and expenses, and cannot be invested into directly. For illustrative purposes only.