Annual Giving vs. Legacy Giving – Strategic Timing

Wiser Way to Give

Annual Giving vs. Legacy Giving – Strategic Timing

Giving with Purpose: When to Give for Maximum Impact ✨

Philanthropy is more than just generosity—it’s about making the right giving decisions at the right time. Whether you donate annually, plan gifts around major life events, or incorporate philanthropy into your estate plan, timing matters just as much as the donation itself.

A strategic approach to charitable giving can maximize tax benefits, preserve family wealth, and create lasting impact. But how do you decide between annual giving and legacy giving? And how can a financial advisor help you optimize your charitable strategy?

In this edition of Wiser Way to Give, we explore the key differences between annual and legacy giving and how thoughtful timing can help you achieve your philanthropic goals while staying financially secure.

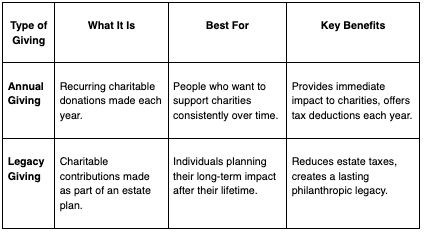

📌 Annual Giving vs. Legacy Giving: What’s the Difference?

Choosing when and how to give depends on your financial situation, tax planning goals, and long-term vision for your wealth.

📊 Key Strategies for Smart Giving

1️⃣ Annual Giving: Smart Charitable Contributions in the Present

💡 Ideal for those who want immediate impact while reducing annual taxable income.

✔ Donor-Advised Funds (DAFs) – Contribute a large amount now, take an immediate tax deduction, and distribute donations over time.

✔ Gifting Appreciated Assets – Donate stocks, real estate, or collectibles to avoid capital gains tax while claiming a full market value deduction.

✔ Bunching Donations – Combine multiple years’ worth of donations in a high-income year to maximize deductions.

✔ Gifting Appreciated Assets – Donate stocks, real estate, or collectibles to avoid capital gains tax while claiming a full market value deduction.

✔ Bunching Donations – Combine multiple years’ worth of donations in a high-income year to maximize deductions.

📌 Example: Instead of giving $10,000 annually for five years, a donor contributes $50,000 in one year to a DAF, taking a larger tax deduction upfront while distributing the funds over time.

2️⃣ Legacy Giving: Long-Term Philanthropy Built Into Your Estate Plan

💡 Best for those looking to create a lasting charitable impact while optimizing estate and tax planning.

✔ Charitable Remainder Trusts (CRTs) – Allows donors to receive income for life while ensuring the remainder goes to charity.

✔ Bequests in a Will or Trust – A simple way to leave a portion of your estate to a charity.

✔ Qualified Charitable Distributions (QCDs) – If you're 70½ or older, donate directly from your IRA to lower taxable income while fulfilling required minimum distributions (RMDs).

✔ Bequests in a Will or Trust – A simple way to leave a portion of your estate to a charity.

✔ Qualified Charitable Distributions (QCDs) – If you're 70½ or older, donate directly from your IRA to lower taxable income while fulfilling required minimum distributions (RMDs).

📌 Example: A retiree donates $500,000 from their estate to a nonprofit, reducing their estate tax liability while ensuring long-term support for their favorite cause.

Case Study: Structuring Philanthropy for Maximum Impact

Meet Mark & Linda: A Strategic Approach to Giving

Mark (65) and Linda (62) have been lifelong donors, contributing $50,000 annually to various nonprofits. However, after selling a family business for $5 million, they needed a tax-efficient way to maximize their impact while reducing their estate’s tax burden.

Initial Giving Approach:

🔹 $50,000 in annual donations

🔹 No structured long-term giving plan

🔹 No structured long-term giving plan

Optimized Giving Plan (With Their Financial Advisor):

✔ $1 million into a Donor-Advised Fund → Immediate tax deduction, long-term donation flexibility

✔ $1.5 million into a Charitable Remainder Trust (CRT) → Provides lifetime income while benefiting charities in the future

✔ $300,000 in stock donations → Eliminates $75,000 in capital gains tax

✔ $1.5 million into a Charitable Remainder Trust (CRT) → Provides lifetime income while benefiting charities in the future

✔ $300,000 in stock donations → Eliminates $75,000 in capital gains tax

Results:

✅ Reduced taxable income by $2.8 million

✅ Deferred capital gains tax on stock donations

✅ Created a structured, long-term giving plan

✅ Deferred capital gains tax on stock donations

✅ Created a structured, long-term giving plan

By blending annual and legacy giving, Mark & Linda lowered their tax burden while building a philanthropic legacy that will last beyond their lifetime.

💡 Key Takeaways: Choosing the Right Giving Strategy

✔ Annual Giving = Immediate Impact – Great for donors looking to support charities now while reducing taxable income each year.

✔ Legacy Giving = Long-Term Impact – Ideal for those who want to preserve wealth while ensuring charitable contributions continue after their lifetime.

✔ Blended Giving = The Best of Both Worlds – Combining annual and legacy giving strategies can provide both immediate tax benefits and long-term financial security.

✔ Work with a Financial Advisor – Advisors help structure donations efficiently while ensuring they align with your estate and financial goals.

✔ Legacy Giving = Long-Term Impact – Ideal for those who want to preserve wealth while ensuring charitable contributions continue after their lifetime.

✔ Blended Giving = The Best of Both Worlds – Combining annual and legacy giving strategies can provide both immediate tax benefits and long-term financial security.

✔ Work with a Financial Advisor – Advisors help structure donations efficiently while ensuring they align with your estate and financial goals.

FAQs: Crafting a Giving Strategy That Works for You

Q: How do I know if I should focus on annual giving or legacy giving?

✅ It depends on your financial situation. If you want immediate tax benefits, focus on annual giving. If you’re planning for the long-term, legacy giving might be a better fit.

✅ It depends on your financial situation. If you want immediate tax benefits, focus on annual giving. If you’re planning for the long-term, legacy giving might be a better fit.

Q: What’s the tax deduction limit for charitable contributions?

✅ Cash donations: Up to 60% of AGI | Non-cash assets: Up to 30% of AGI.

✅ Cash donations: Up to 60% of AGI | Non-cash assets: Up to 30% of AGI.

Q: Can I give too much at once?

✅ If your donations exceed IRS limits, you can carry forward excess deductions for up to five years.

✅ If your donations exceed IRS limits, you can carry forward excess deductions for up to five years.

Q: Is legacy giving only for the ultra-wealthy?

✅ Not at all! Anyone can incorporate charitable giving into their estate plan, even with modest assets.

✅ Not at all! Anyone can incorporate charitable giving into their estate plan, even with modest assets.

🚀 What’s Next in Wiser Way to Give?

🔹 How to Involve Your Kids in Giving Decisions

🔹 Teaching Philanthropy Through Fun Activities

🔹 Teaching Philanthropy Through Fun Activities

💡 How Do You Approach Philanthropy?

We’d love to hear your thoughts! Reach out to explore creative ways to align your financial goals with your charitable vision. 🌟

📢 Disclaimer

This information is provided for educational purposes only and should not be construed as tax or legal advice. Please consult your financial, tax, or legal professionals before implementing any charitable giving strategies. The information presented is based on sources deemed reliable; however, accuracy and completeness are not guaranteed.